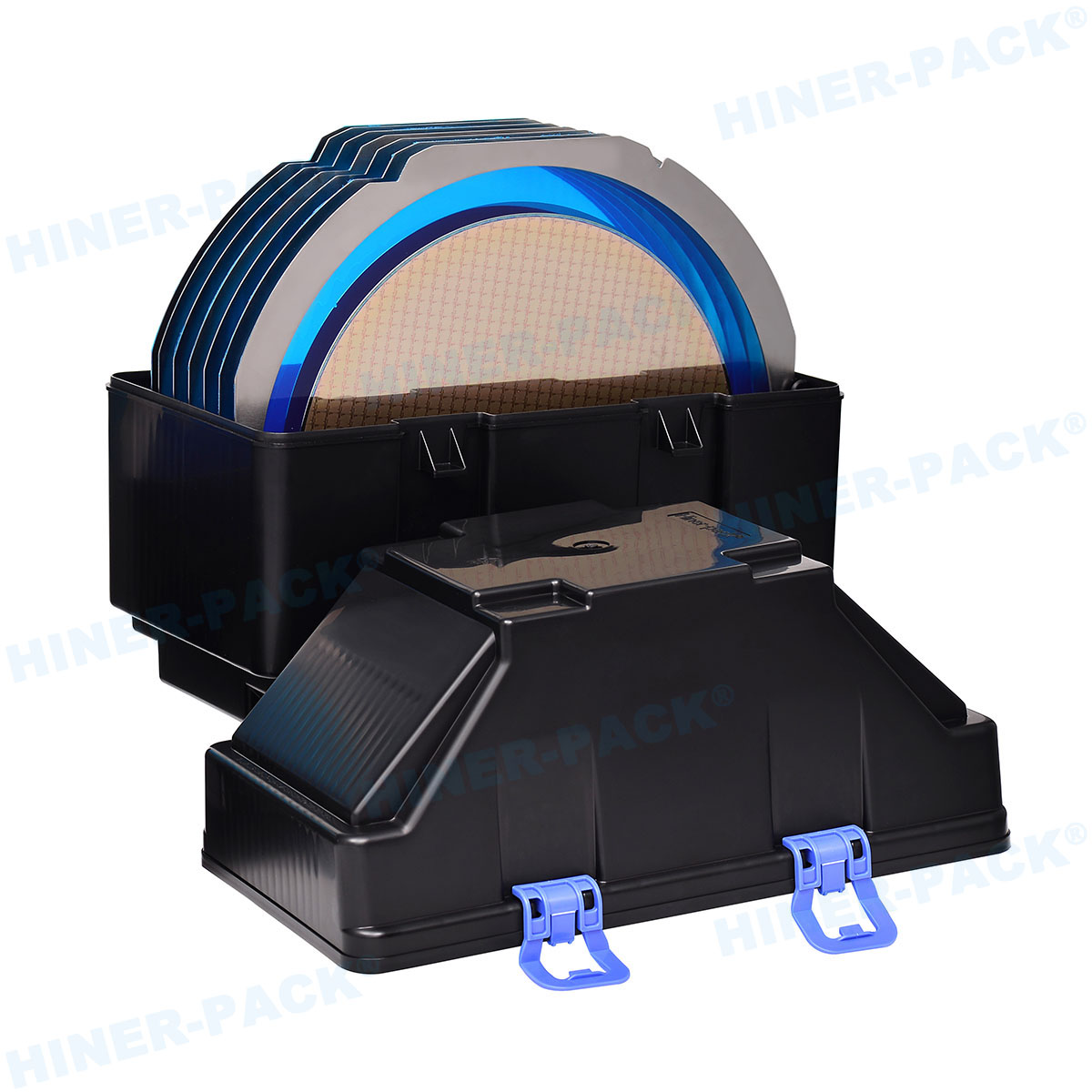

Recently, the research and statistical data released by Hengzhou Chengsi showed that the global market size of wafer shipping carriers in 2024 is approximately 4.91 billion yuan, and it is expected to reach nearly 7.15 billion yuan by 2031, with a compound annual growth rate (CAGR) of 5.5% over the next six years, demonstrating a stable and sustained growth trend in this market. Behind this growth trend lies the strong support of the booming semiconductor industry. With the accelerating pace of electronic product upgrades, from smartphones and computers to various types of smart wearable devices, the demand for semiconductor chips has exploded. As a crucial part of chip manufacturing, the importance of wafer storage and transportation, and its carrier, the wafer cassette, is self-evident.

From a geographical perspective, Taiwan, China, is the largest consumer region for wafer cassettes, accounting for nearly 19.75% of the consumption market share in 2022. Taiwan is home to globally renowned semiconductor manufacturing companies such as TSMC, with a highly developed semiconductor industry chain and a huge demand for wafer cassettes. Following closely are countries and regions such as the United States, Mainland China, South Korea, and Japan, where the demand for high-quality wafer cassettes continues to rise. In recent years, Mainland China has made significant investments in the semiconductor industry, with companies like SMIC continuously expanding production capacity and upgrading technology, driving the rapid development of the wafer cassette market.

However, the wafer cassette industry has high barriers to entry, requiring advanced production technologies. Currently, the industry is mainly dominated by companies from the United States, Japan, South Korea, Taiwan, China, and other countries and regions. Meanwhile, gross profit margins may experience certain fluctuations, requiring companies to continuously enhance their core competitiveness by means of technological innovation and increasing product added value to stabilize profit margins. Despite fierce competition, due to the global economic recovery and continuous technological advancements, the demand for electronic products will remain high. Investors remain optimistic about this field, and it is expected that new investments will continue to enter in the future.